Only 45% of contractors intend to keep contracting via their Personal Service Company after April 6th 2021

A survey by Qdos and obtained by Contractor UK has highlighted that most contractors will not keep working via their same size, one-person limited company as a direct consequence of private sector IR35 reform.

- 18% plan to close their company,

- 17% could join a payroll,

- 6% will retire, and

- 14% have ‘other plans’

The article shares that “Only 45% of contractors intend to keep contracting via their Personal Service Company (PSC) after April 6th 2021, versus the 55% for whom the status quo will end.

Although that 55% includes the 14% with ‘other plans,’ those plans were specified as setting up a completely ‘new business’ or ‘expanding their current’ company beyond its present size.”

Check out the article by Simon Moore for additional info and further analysis.

HMRC announces plans to resolve Off-Payroll drafting errors

An article shared by ContractorCalculator confirms that “HMRC has announced its intention to resolve a recent amendment to the drafting of the Off-Payroll legislation that causes unintended consequences throughout the contractor supply chain.”

If you’ve missed the discussions, the amendment would currently classify a party directly remunerating inside IR35 contractors as an intermediary. This effectively means that PAYE tax deductions would be carried out prior to this.

As Contractor Calculator states “The ramifications were widespread, including disruption to the use of umbrella companies, multi-agency supply chains, consulting firms and employees on secondment.”

Before you read on …

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world.

Been impacted by IR35? Please take this short survey

Literally one minute to complete and the outcome will be an interesting read. Check it out here.

Includes questions such as “To what extent has dealing with IR35 legislation negatively affected your mental wellbeing?” and, “As a contingent worker, how valued do you feel by your organisation?”

Worth completing and asking to be included in the results I reckon…

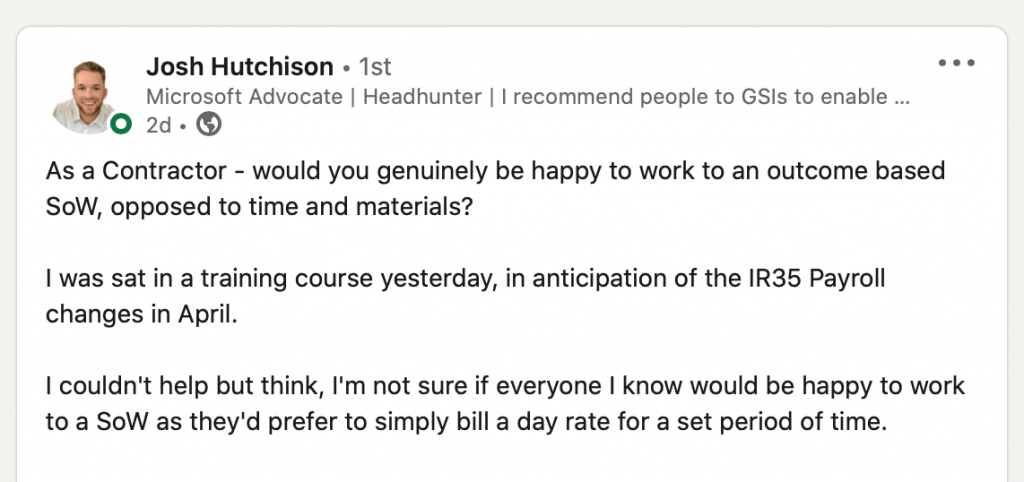

A LinkedIn discussion about SoW’s with 140 comments? Yes please…

Statements of Work have long been talked about as an option to help with an outside IR35 status. We all know though that it’s just not as simple as that.

This post certainly generated a lot of discussion about both the reality of this for both clients and contractors.

What an HMRC appeal of Kaye Adams’ IR35 case might mean for contractors

Interesting write up from David Harmer, associate director of contractor solutions at Markel UK in Contractor UK this week.

“The main thrust of HMRC’s appeal, we suspect, will be on Control… In concluding their reasoning, the tribunal stated that the BBC exercised a “light touch”, and while they concluded that this allowed them to decide the engagement was outside of IR35, the very reference to this indicates that they acknowledge some right of control existed.

We expect HMRC will exploit this and attempt to demonstrate that the BBC’s right of control extended to the manner in which Kaye Adams provided the services and try to demonstrate the BBC had the ultimate right of control over her methodology.”

…and finally…. what would you be?

So, purely for the purposes of research, I took the assessment to see what I should re-skill as. It came up with three industries initially – Sports and Leisure, Creative and Media and Construction. Within those, my options seem to be…

- Actor

- Football Referee

- Refrigeration and air-conditioning installer

Good, all sorted then.

Here’s the link if you’d like to check it out…

https://beta.nationalcareers.service.gov.uk