The most prickly of problems: employee vs self-employed tax

Excellent article in AccountingWeb by Employment Status & IR35 expertRebecca Seeley Harris.

As stated in the article, the Office of Tax Simplification (OTS) released its evaluation update and stock take of the work it has carried out on corporation tax, personal service companies and self-employed people’s taxation. As a previous a Senior Policy Adviser to the OTS, Rebecca was personally involved with some of this earlier work.

The article covers PSC tax, previous OTS work, future possible work and a conclusion with useful links to work published that may influence future direction.

Is the time now right for the government to grasp the nettle of this most prickly of problems?

Check out the comments too – it’s always good when comments are open on a post, and this post attracts several.

Before you read on …

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world

From a contractor… to contractors

It was so great to see this video. A contractor providing (as he puts it) “..a few meat and potato things to think about”.

In particular, the focus on changing mindset is key and Jac Hughes gives some great ideas as to how to do this.

More please Jac 🙂

IR35 status disagreement process: off-payroll explainer for April 2021

Here David Harmer from Markel Tax has written a useful article for ContractorUK highlighting how the end-client must implement its own “disagreement” process to allow the contractor to raise any objections to the Status Determination Statement (‘SDS’).

The article covers the end client obligations, practicalities of the process, timing and how to disagree.

Can contractors prove they ‘Control’ the service they provide?

This question is answered in Contractor Weekly...if you’re interested in the answer, check it out…

“With IR35 reform on the horizon, I’ve been doing some thinking about what it means to provide a service that legitimately belongs outside IR35, which is where my contract currently sits.

Whilst I realise that IR35 status isn’t always clear cut, I know that being able to demonstrate that I am not controlled by my client is important when working outside IR35.

However, because we are answerable to our clients, as contractors are we ever really in control of the engagement?”

The IPSE Freelancer Confidence Index for Q2 2020 is out

IPSE’s Freelancer Confidence Index is a quarterly report that tracks the business performance and economic outlook of freelancers across the UK. It is the only established index of its kind, using rigorously tested methodology and a representative sample of the freelance sector.

Here’s a very brief summary of some of the key findings published. it’s worth reading the full report for all data and insights.

- Freelancers expect the UK economy to deteriorate even further in the next year, with a 12-month UK economy index score of -53.4.

- The coronavirus pandemic (81.1%) is now not only the top negative influence on freelancers’ businesses, but it is also selected as a top factor by all three freelancer occupational groups.

- In Q2 2020, freelancers’ spare capacity reached an unprecedented record high of 5.5 weeks, increasing substantially since Q1 2020 when it was at 3.3 weeks.

- The great decline in capacity utilisation alongside a slight fall in day rates led to a large 25 per cent drop in quarterly earnings from £20,821 in Q1 2020 to £15,709 in Q2 2020.

PSC Directors should be … grateful?

Christian Hickmott, Chief Executive of Integro Accounting highlights in an articlefor Contractor UK that Jesse Norman effectively claimed last month that personal service company directors should be grateful for the various benefits available. This was to defend against the charge that with private sector IR35reform, the government will impose ‘zero-rights employment’ on contractors.

The article states that …In the Finance Bill debate of July 1st, the Treasury minister stated: “Such benefits include statutory maternity, paternity, adoption, parental bereavement and shared parental pay, and they are provided by PSCs, which are then able to claim 100% of those payments plus 3% compensation from the government.”

Christian takes a look at five key benefits and assesses them from a PSC directors perspective.

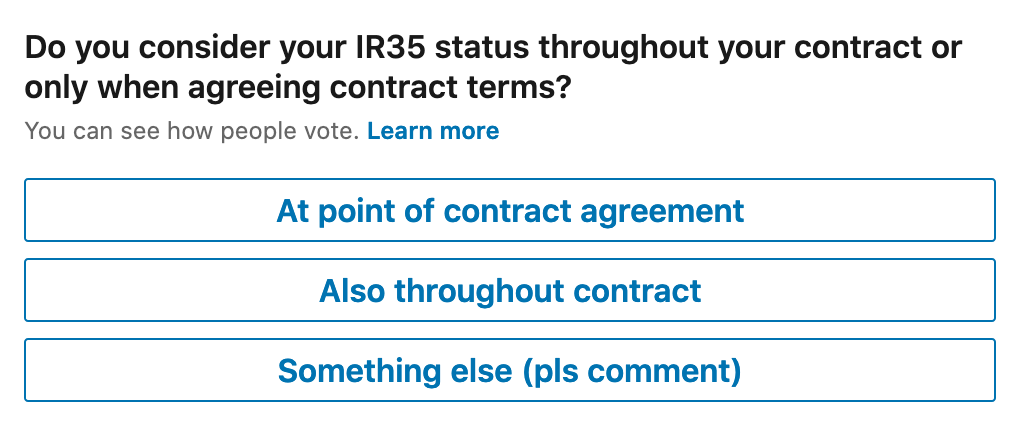

It’s contractor poll time!

Thank you to the reader who suggested this one – please click the link and answer the poll to receive a great prize (the gift of seeing everyone elses answers 🙂 ).

Final answers in next weeks newsletter.

Remember!

If you see something interesting (or have written something), do send it through via the website so it can be shared with the community. If there are other people who you think would like this email just send it on, or share the link – www.IR35Weekly.uk.

If you want to get in touch directly, email us at news@ir35weekly.uk