Worried About A HMRC Investigation Post April 2021? Here’s what to expect…

An excellent article from Seb Maley the CEO of Qdos Contractor taking us through what IR35 off-payroll investigations will look like from April 2021.

This detailed article covers all players in the supply chain and includes what to expect in the opening letter, the response, the meeting and the investigation itself plus a whole host of other useful information.

Fail to prepare and all that…

Before you read on …

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world.

IPSE Webinar – IR35 in the private sector: what’s next?

Join IPSE’s Director of Policy, Andy Chamberlain as well as Markel’s Head of Tax Partnerships, Paul Mason in this webinar, to find out what the changes could mean for you and how to prepare.

They took an in-depth look at how IR35 will change and offered practical advice on a range of areas including:

- Status Determination Statements (SDSs)

- The small company exemption

- Contracted out services

- The client-led dispute resolution service

- Statement of work contracts

The Government Response to the report from the Economic Affairs Finance Bill Sub- Committee on off-payroll working

So, here it is, the response from the Government. Content as expected given the discussions regarding the Bill.

“The Government firmly believes that reforming the rules and transferring the responsibility for determining whether they apply from individual contractors to the firms that engage them will be a step towards greater fairness in the tax system.”

The response includes

- Employment rights,

- Independent review

- Market impacts and blanket assessments

- Education, support and CEST

- Cost to business

- Umbrella companies

- Alternatives

IR35 private sector reforms: Government response to Finance Bill Sub-Committee inquiry slammed

In an article by Caroline Donnelly of Computer Weekly “The government stands accused of downplaying the dampening impact the incoming IR35 reforms are having on the private sector’s appetite for hiring limited company contractors, in its response to the Finance Bill Sub-Committee’s recent inquiry to the changes.”

Boris Johnson and Rishi Sunak personally intervened to stop private sector IR35 reform amendments

So here’s how it all worked behind the scenes… a great article by Simon Moorein ContractorUK.

“Boris Johnson and Rishi Sunak personally stepped in to stop ‘contractor-friendly’ Finance Bill amendments on private sector IR35 reform from going ahead, ContractorUK can reveal.

The behind-the-scenes interventions by both the prime minister and the chancellor is cited by MPs in letters to constituents, who asked how off-payroll Amendment 20 failed when it was initially so widely supported.”

“Let me set out for you again why we are introducing this reform…”

Want to see the letter from Rishi Sunak explaining this to MP, David Mundell? Check it our here – shared by Kirti Shukla. Worth also reviewing for the comments on the post.

“The Prime Minister’s favour is not something to be cast aside…”

Here’s another letter, this time from Crispin Blunt MP that clearly highlights how these thing work.

Thanks for sharing Kirti Shukla. As you’d expect, there’s quite a few comments on LinkedIn to browse through on this one.

New Recruiter Reveals All! Podcast – First episode with Dave Chaplin

Our keen eyed spies noticed this tweet from @RecruiterMag. Keep your eyes peeled for their brand new Podcast – Recruiter Reveals All! The first episode features Dave Chaplin of IR35Shield and Contractor Calculator fame. They’ll be talking about the countdown to IR35 compliance.

Follow them to catch the date when it’s announced.

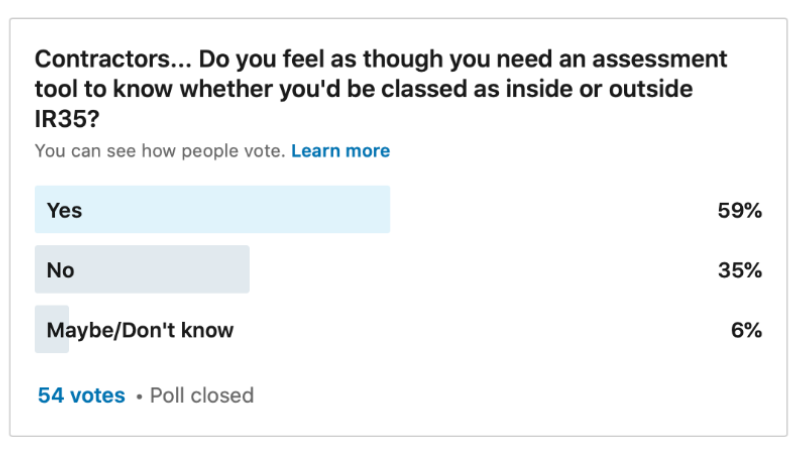

Do You Need An Assessment Tool?

Last week we asked the LinkedIn community…

“Given how much information is freely available now. Do you feel as though you need a tool to be confident in assessing whether your contract (and way of working) is inside or outside IR35?”

As we become more comfortable with the regulations and there are further clarifications through case law, maybe this will reduce? Feel free to comment on the post if you have a view!

Remember!

If you see something interesting (or have written something), do send it through via the website so it can be shared with the community. If there are other people who you think would like this email just send it on, or share the link – www.IR35Weekly.uk.

If you want to get in touch directly, email us at news@ir35weekly.uk