Myths and tips from inni Accounts

Well done to inni Accounts for sharing bite sized gems of information, helping to bust some of the myths of IR35.

We normally only share articles, posts and events, but these videos are a great way to get key information out there so we made an exception 🙂

Before you read on …

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world.

Getting the best out of CEST: how to work with HMRC’s IR35 tool, if you must

An article here from Seb Maley CEO of Qdos Contractor who, when looking at CEST asks the question…

“Should hiring organisations trust it to accurately assess a contractor’s tax position? And if they insist, what can contractors do – if anything – to help make sure their status is determined accurately by CEST?”

There are many tools available now, so it’s no surprise that CEST is getting a hard time both in terms of there being alternatives and due to the widely reported shortcomings. It’s still HMRC’s tool though, so my guess is that it’s unlikely to be going anywhere any time soon.

What’s happening right now in contractor recruitment, thanks (and no thanks) to covid-19

An entertaining article in ContractorUK from Natalie Bowers, co-founder of niche financial staffing agency Bowers Partnership.

To give you an idea, here are the sub headings of the article.

- Contracts? They went through the floor

- The dog that didn’t bark

- Cause to celebrate

- Blissful

- Skype versus a hot coals stroll

TRIBUNAL WATCH: Locum contractor found NOT to be employee

A useful LinkedIn post from Dave Chaplin this week sharing an ET ruling….

“This is an ET ruling, not a tax ruling, but features the usual manner of judging whether someone is an employee or not. The locum contractor was claiming rights, as either a Worker or Employee. The appeal was unsuccessful.”

Worth a read for the post and comments … “This is not a binding ruling, because it’s ET, not EAT, but contractors can try and use it as persuasive arguments.”

Events

Webinar – The impact of remote and flexible working on contracting

Wednesday 2nd September at 1pm BST

Join Ben Moses (European Director) and Charlotte Rigby (Director) from Oliver James Associates who will be discussing the impact of increased flexible and remote working on contracting, what skills and industries are in demand, and the latest on IR35.

Roundtable – IR35 Roundtable Q&A with Brookson by Realtime Recruitment

Thursday 3rd September at 10am BST

Realtime Recruitment are partnering with IR35 experts, Brookson, and are hosting an IT Contractor Q&A roundtable to help you prepare for the legislative changes in April 2021.

Tired of waiting? …40,000 backlog at Employment Tribunal

From Contractor Tap, “a legal employment expert has estimated some 40,000 cases may be waiting to be heard by the Employment Tribunal, due in large part to a lack of funding for HM Courts & Tribunal Service in recent years.”

Contractors have historically dealt more with the Tax Tribunal in employment status matters, however from April contractors may seek clarification from the Employment Tribunal as to whether they are due the rights of employees, such as sick pay, holidays and other statutory benefits.

If this is the case, be ready for a wait.

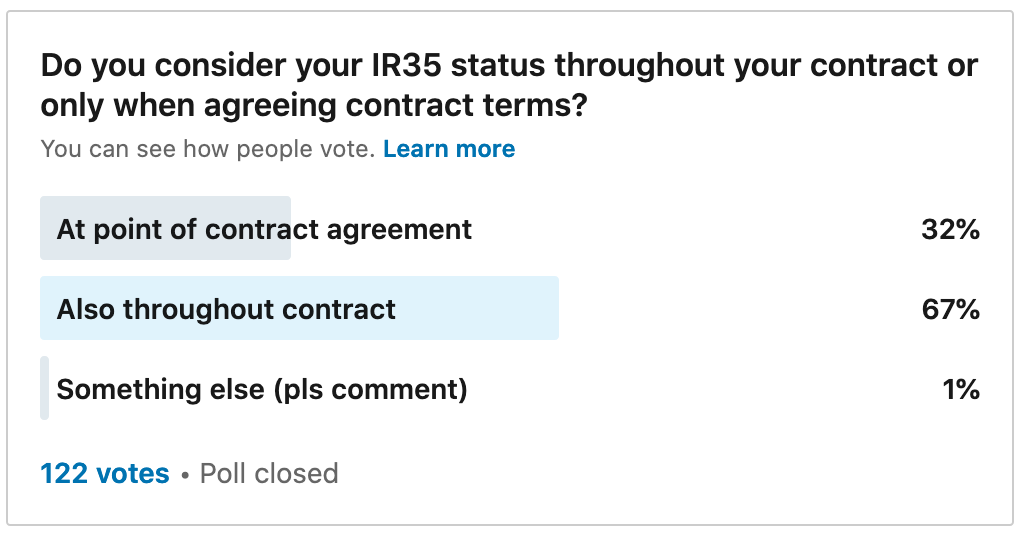

The results are in!

Here are the poll results. From the 122 votes;

At point of contract – 39

Also throughout contract – 82

Other – 1

Thank you Kirti Shukla for sharing it, there are a number of comments that add additional context to the post here.

If you’d like to ask the contractor world a specific question, let me know and I can share and promote.

Contractors, here’s what you can take from covid-cautious clients mandating WFH

This article by Matt Craven, the Founder of The CV & Interview Advisors and Linked-In-Credible, shares…

“In a week where two jewels in London’s financial crown committed much or all of their workforces to working from home because their covid-19 experience has been pretty good, it’s worth pondering how this may affect the kings and queens of work from anywhere — contractors, because it might rub off on both IR35 and marketing.”

Remember!

If you see something interesting (or have written something), do send it through via the website so it can be shared with the community. If there are other people who you think would like this email just send it on, or share the link – www.IR35Weekly.uk.

If you want to get in touch directly, email us at news@ir35weekly.uk