Emotions scheduled for next week

Of course the main conversation at the moment in IR35 world is that the Report Stage of the Finance Bill is next week. We’re specifically looking to see if there are amendments to the bill.

Kirti Shukla shared the show timings;

Report Stage & Third Reading are…

- Wed 1st July at 1200 ( after PMQs )

- Thur 2nd July at 9:30 ( after Oral Questions )

Importantly…

- Amendments can be made to the Bill at Report Stage.

- Amendments to be considered are selected by the Speaker.

- This is the last chance to influence these amendments. Here’s how.

One thing that was interesting was that neither the House of Lords letter nor report was mentioned in a Parliamentary Briefing Paper published on 22nd June. Here’s the report via a post from Kirti and associated discussion.

Also check out Dave Chaplin‘s post on LinkedIn for more info from him and to join their Stop the Off Payroll Tax campaign (sign up required).

Before you read on …

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world

Really Jesse?

In Contractor UK, Simon Moore shares that the (some might say) out of touch Jesse Norman “..has denied that private sector reform is having “a chilling effect” on the flexible labour market, despite being told that IT contractors are losing their contracts over it.

The Treasury minister preferred to characterise the contract losses as a ‘nudge’ that “some companies” are “undoubtedly” giving to workers who they suspect are disguised employees”

It’s a good article, also covering not listening to the House of Lords, the likelihood (or not) of a U-turn and gearing up before Apr 2021. Worth a read.

Part 2 – Post-Match Discussion

Last week we shared Part 1 – now it’s time for Part 2. So here’s the post-match discussion on the IR35 proceedings in Kickabout with Dave Chaplin and Keith Gordon discussing the arguments raised and trying to predict the outcome of the case.

As Keith so wonderfully describes.. “Two middle-aged blokes discussing a tax case (Kickabout, IR35) – immediately after the Upper Tribunal has heard the parties’ arguments.”

The IR35 Goose

In their latest article, the Self-Employed Alliance share that the “…IR35 Goose currently allows collection of 13.8% Company National Insurance Contribution (NIC) via Inside IR35 blanketing decisions in the Public Sector and No PSCs (Personal Service Companies) blanketing decisions in the Private Sector.”

In this, they cover blanket decisions, umbrella companies, consultancies, the elephant in the room and what you can do. But you need to do it now so check out the post.

Events!

Thanks WTT Consulting for an excellent line up on Wednesday. The talks were informative and questions interesting too – especially those around retrospective action, insurance and liability down the chain. If you weren’t able to make it, perhaps get in touch with Rhys Thomas or Tom Wallace.

A reminder about what’s coming up…

1st July

3 Ways Businesses Prepared for 2020 IR35 Reform … And Which to Follow, by Qdos Contractor

A free 1 hour IR35 webinar where they will be analysing the approaches taken by companies in the lead up to reform, which worked and which didn’t. This webinar is suitable for hiring organisations and recruitment agencies. Speakers are Seb Maley (CEO) and Nicole Slowey (Operations Director).

Do you have an event you want to share? Email us at news@ir35weekly.uk

and finally…

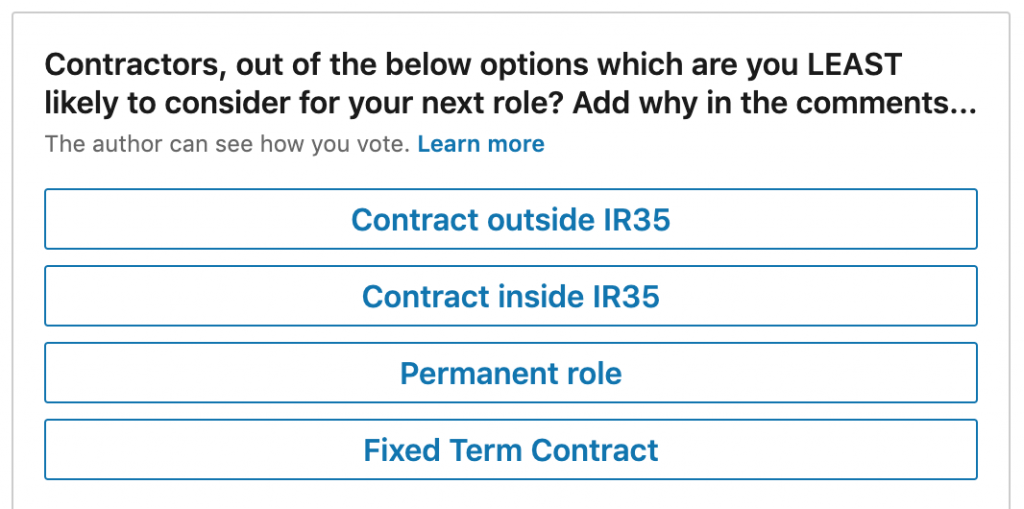

One just for the contractor readers. What are you LEAST likely to choose?

Juliet Eccleston posted this last night and it’s already had over 150 votes. We will share the results in next weeks newsletter. Answer it here to get involved…

Remember!

If you see something interesting (or have written something), do send it through via the website so it can be shared with the community. If there are other people who you think would like this email just send it on, or share the link – www.IR35Weekly.uk.

If you want to get in touch directly, email us at news@ir35weekly.uk

Thanks!