IR35 reform gets green light for April 2021

So, as reported in the FT Adviser, the new IR35 rules are one step closer to being introduced in April 2021.

Conservative MP David Davis campaigned for an amendment which would see the rules be delayed until 2023/24, particularly in light of the economic impact of the coronavirus pandemic.

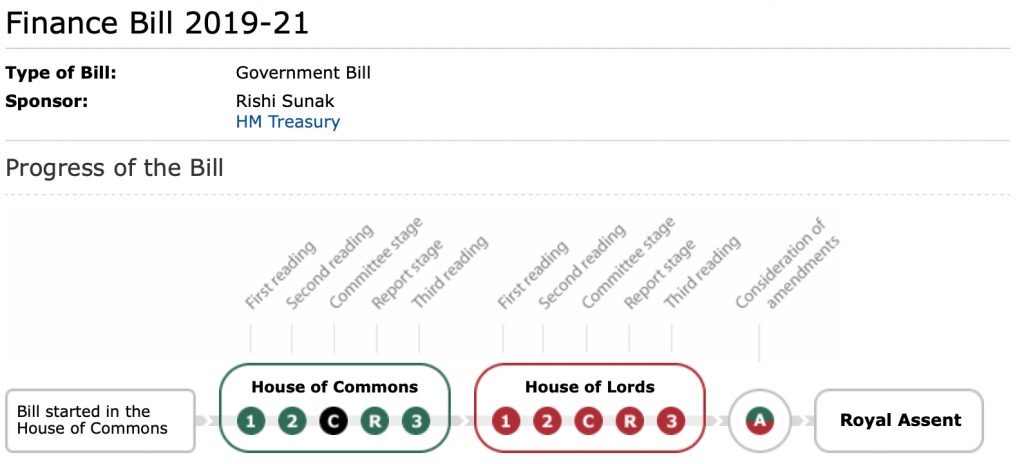

MPs failed to vote on the amendment, meaning the changes are one step closer to being introduced in April 2021 as the bill moves to the committee stage within parliament.

This was heavily reported on across all of the usual channels and there were many posts on LinkedIn. Here’s Dave Chaplin’s post that had attracted nearly 200 comments when we last looked…

Before you read the rest of the (much nicer) news…

- If there are others you think that would benefit send it on, or share the link – www.IR35Weekly.uk.

- For those who have just joined us, welcome! You can view previous news on the website.

- If you have stuff to share let us know and we’ll give a shout out to the (IR35) world.

Where are we?

Dave Chaplin confirms in this useful LinkedIn post here that “The Finance Bill is not “approved” and the Off-Payroll Tax is not currently now definite.”

“The Government are basically where they wanted to be after the second reading, having now included the Off-Payroll roll-out in the draft Finance Bill, ready to be considered at the next stages. There was no vote on the Davis amendments today either.”

Check it out for clarity on the progress of the bill and what’s next.

If you want to sign up to Stop The Off-Payroll Tax Campaign, and receive their updates, you can do so here.

Rewind…

In IR35 Weekly News #8, we shared that in HMRC v. PGMOL [2020], HMRC lost in the Upper Tribunal on mutuality of obligations point. Thankfully Rebecca Seeley Harris has dissected the latest case so we can have a replay. This has very good content on mutuality of obligations and guidance on the legal and non-legal documents that should be used in practice.

As she reminds us… “Regardless of when the off-payroll reforms are going to come in, someone in the supply chain is still responsible for checking they are complying with tax legislation.”

Check out the excellent article which also has useful debates in the comments.

Navigating the hybrid job landscape

Matt Fryer, Head of Legal Services at Brookson Legal shares an article on Contractor UK, saying that for the foreseeable, contractors will be – and already are left to navigate a hybrid job landscape, during what looks likely to be the most challenging global recession in living memory.

The article covers many topics, from being unprepared for he rule in April 2020, to managing tax and questioning whether companies recovering from the economic shock of COVID-19 will take action to address their IR35 responsibilities in time for the new deadline.

…and finally,

Kirti Shukla of the Self-Employed Alliance has a survey for you. They want to hear from all business owners or directors of limited companies and their experience of the COVID crisis. The Government’s Furlough Scheme (CJRS) allows many from this group to fall through the cracks.

The survey should take no longer than 10 minutes to complete and looks to evidence Coronavirus epidemic impact on you, the support you have received and need as well as what is the look-ahead for limited companies.

Deadline – 25th May

Remember!

If you see something interesting (or have written something), do send it through via the website so it can be shared with the community. If there are other people who you think would like this email just send it on, or share the link – www.IR35Weekly.uk.

Thanks!